|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

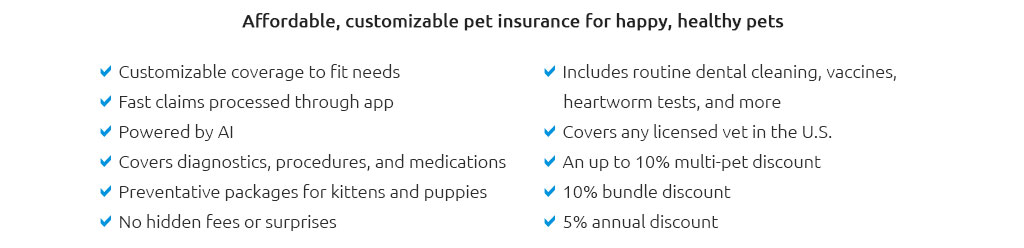

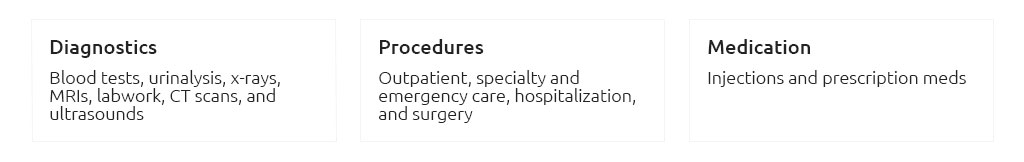

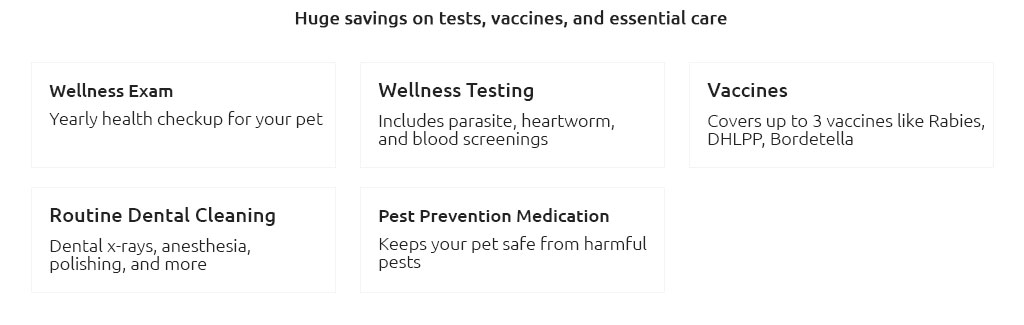

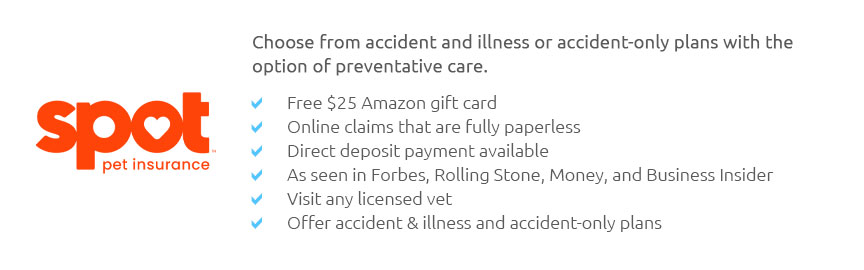

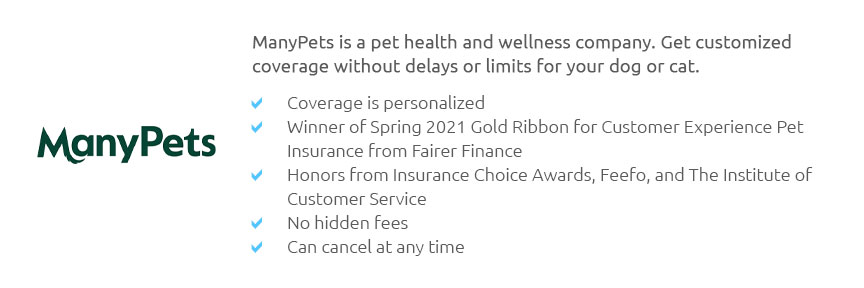

Pet Insurance Premium Comparison: Navigating the Maze of OptionsIn today's world, where pets have transcended from mere companions to cherished family members, ensuring their health and well-being has become a top priority for many pet owners. One of the most effective ways to safeguard your pet's health is through pet insurance, a safety net that can shield you from exorbitant veterinary costs. However, with a myriad of insurance providers vying for your attention, comparing pet insurance premiums can seem like navigating a labyrinth. This article aims to demystify the process, highlighting the crucial factors that should guide your decision-making. At the heart of pet insurance lies the premium, a monthly or annual fee that policyholders pay to keep their coverage active. The premium amount can vary significantly across different providers, influenced by a multitude of factors such as your pet's breed, age, and overall health. While it might be tempting to gravitate towards the cheapest option available, it's essential to delve deeper into what each policy offers. Inexpensive plans might come with limited coverage, higher deductibles, or more exclusions, which could prove costly in the long run. When comparing pet insurance premiums, one should start by evaluating the coverage options. Does the plan cover only accidents, or does it extend to illnesses, hereditary conditions, and routine care? Policies that offer comprehensive coverage tend to have higher premiums, but they also provide peace of mind, knowing that a wide range of potential health issues are covered. Moreover, consider the deductibles and reimbursement levels. A higher deductible can lower your premium, but it means you'll pay more out of pocket before insurance kicks in. Likewise, reimbursement levels dictate how much of the vet bill you'll get back; higher reimbursement percentages usually mean higher premiums. Another pivotal factor is the policy limits. These can be annual, per incident, or lifetime limits, and they cap the amount an insurer will pay. Policies with higher limits often come with steeper premiums but can be a wise investment if your pet requires costly treatments. Additionally, the waiting periods-the time before coverage begins-can vary and affect when your pet becomes eligible for benefits. As you sift through various policies, reading the fine print is crucial. Look out for exclusions, which are conditions or treatments not covered by the insurance. Common exclusions include pre-existing conditions, elective procedures, and breeding-related costs. Understanding these exclusions will prevent unpleasant surprises when filing a claim. Furthermore, consider the insurance provider's reputation. Researching customer reviews, claim processing times, and the company's financial stability can provide valuable insights into their reliability and customer service quality. A provider with a history of prompt and fair claim settlements is often worth the extra premium. While comparing premiums, it's worth noting that many insurers offer discounts, such as multi-pet discounts, which can reduce costs if you have several pets. Also, some providers offer price-lock guarantees, ensuring your premium won't increase unexpectedly. In conclusion, comparing pet insurance premiums involves more than just finding the lowest price. It's about balancing cost with the breadth and depth of coverage, ensuring that your furry friend receives the best possible care without breaking the bank. By considering the factors outlined above, you can make an informed decision that aligns with both your financial situation and your pet's health needs. FAQs on Pet Insurance Premium Comparison

https://www.aspcapetinsurance.com/research-and-compare/compare-plans/compare-pet-insurance-plans/

comparing pet insurance plans for your cat or dog ; Yes, No, Yes ... https://www.pawlicy.com/

Embrace Pet Insurance - Pets Best Pet Insurance - ASPCA Pet Health Insurance; Pumpkin Pet Insurance; Fetch by the Dodo (previously Petplan) - Figo Pet Insurance ... https://thepetdoctorinc.com/wp-content/uploads/2019/04/veterinary-pet-insurance-comparison-chart-printable.pdf

An illness, disease, injury or change to a pet's health that first occurs or shows signs 1) before coverage is effective or 2) during a waiting period. This.

|